About the author

Andreas Thalassinos, is a respected educator and Certified TechnicalAnalyst. He is a recognized authority in the financial markets industry,and renowned for his expertise in algorithmic trading. After years ofconsulting with many forex brokers on a number of key projects, Andreasofficially returned to the company that he founded and is the principaldriver and architect of FxWizards’ extensive educational programme. Hisinternational seminars and workshops provide clients across the worldwith on-location support, while his webinars, e-books, educational articlesand videos form the cornerstone of FxWizards’ multilingual, open accesstraining resources.

The training is tailored to traders’ needs by region and experience level.Thalassinos has played a key role in the development of financial marketseducation within the industry, training tens of thousands of traders andprofessionals around the world. Traders of all levels value his seminars andworkshops for both content and his passionate and lively presentations.Andreas also plays a pivotal role in FxWizards’ research and developmentteam. In this capacity, he led the development of the FxSwingWizard, VIPTrading Signals, FxWizards Pivot Points Strategy, Currency Strength Meterand Currency Correlations tools, which are designed to help traders spotpotential trading opportunities across various trading instruments.

Thalassinos has been awarded a number of international professionalcertificates including: MSTA by the Society of Technical Analysts (UK)and CFTe and MFTA by the International Federation of Technical Analysts(USA) – the highest qualification in the technical analysis community.

He also holds a BSc and MSc in Computer Science from the University ofLouisiana at Lafayette and Bowie State University, respectively.

His latest research thesis is titled “Anatomy of a living trend: Swing charts,High Points and Low Points, Peaks and Troughs and how their underlyingstructure may define their forecasting strength.”

He currently travels around the globe, appearing as guest speaker onnumerous seminars, conferences and workshops.

Introduction

Welcome to the wonderful world of the financial markets! Since you are reading this, I assume that you have a great interest in tradingthe markets, and you would like to explore some popular trading strategies. All strategies in this ebook are based on technical analysisprinciples and concepts. The technical analysis approach primarily studies the price charts to identify the underlying trend and unveilsits reversal in the opposite direction at an early stage. After all, it is all about timing! Volume, where available, plays an importantleading role as it confirms the price action. In some of the strategies, filtering has been employed as well to filter out the less probablesetups. Furthermore, technical analysis studies the market psychology so you can have a timely entry into the markets.

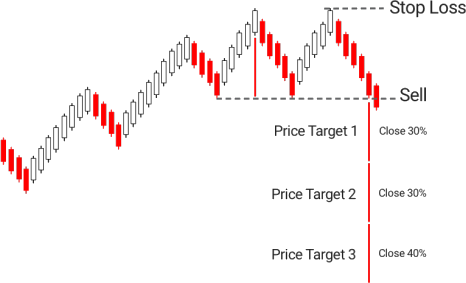

Head & Shoulders

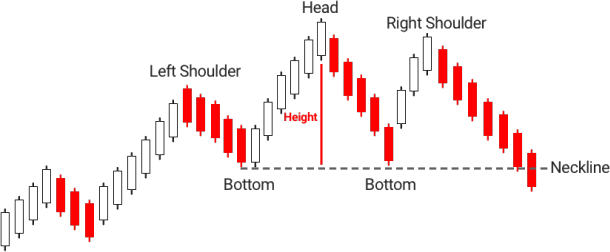

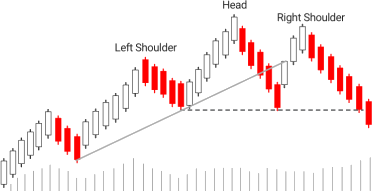

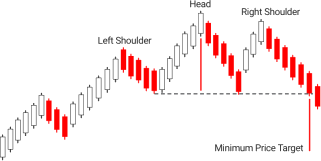

Perhaps, one of the most popular and more reliable technical trading strategies in the financial markets is the Head and Shoulders. It is a chart reversal pattern identified at the top of the trend signaling the end of the established trend and the beginning of a new trend in the opposite direction.

It consists of three tops where the highest top, the middle one, is called the Head, the lower top to the left is the Left Shoulder and the lower top to the right resembles the Right Shoulder. Additionally, there are two dips, corrections if you prefer, that form the corresponding two bottoms. The line that connects the two bottoms is called the Neckline. A decisive breavch of the neckline completes the Head and Shoulders pattern and opens the way for a new trend to the downside.

Requirement

A prerequisite of any reversal pattern is the existence of an established trend. An uptrend is defined as a sequence of successively higher tops and higher bottoms. Some trends are longer than others but as a minimum requirement at least two consecutive higher tops and higher bottoms are required and the price exceeding the second top.

Warnings

Several warnings may appear alerting of the impending formation of the Head and Shoulders:

- The rally to the highest top, that is, the Head, is on a lighter volume compared to the volume of the Left Shoulder. This may be a hint that the uptrend is running out of steam.

- The correction from the Head down to the Neckline dips past the Left Shoulder. Volume is heavier than usual, demonstrating the sellers’ intentions. Furthermore, the correction breaks below the uptrend line.

- Subsequently, the next rally fails to exceed the previous top (i.e. Head), and the Right Shoulder is formed instead.

- Eventually, the price dips lower decisively violating the Neckline on higher volume. It is a signal that the uptrend has ended and a new trend in the opposite direction has just begun.

Price Targets

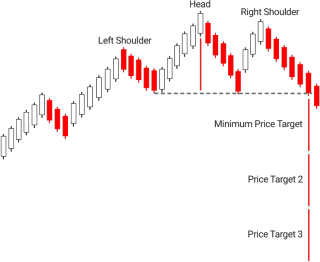

The first price target also known as the Minimum Price Target is measured equal to the Height (distance from the Head to the Neckline) projected from the point where the Neckline was breached.

The second price target, Price Target 2, may be estimated at twice the Height where the third target, Price Target 3 is computed at three times.

Fibonacci fans usually calculate the second target, Price Target 2, at a distance equal to 2.618 of the Height of the structure. The third, Price Target 3 is estimated at 4.236 of the Height. Other variations also exist to suit the trader’s profile.

Entry

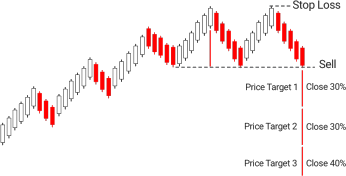

Place a Sell order below the Neckline.

Stop Loss

Place a protective Stop Loss on the top of the Right Shoulder.

Take Profit

Close part of the position at:

- Price Target 1 - 30%

- Price Target 2 - 30%

- Price Target 3 - 40%

Note that percentages may vary to suit one’s risk management rules.

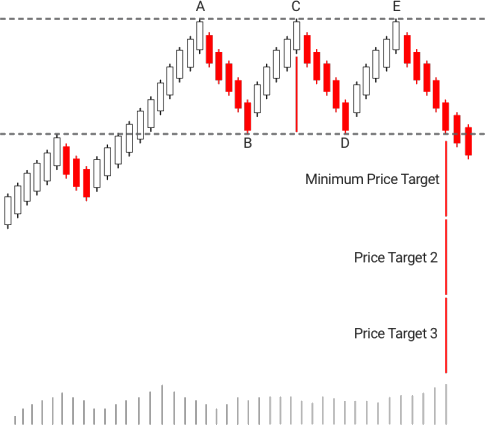

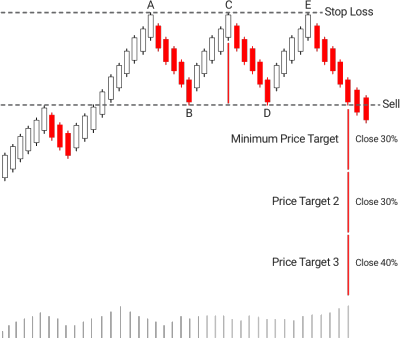

Triple Top

A very similar pattern to Head and Shoulders where all three tops are about the same price level. The volume will give hints for the impending reversal as it will be lighter on the rally to each top. Unless, the price breaks decisively below the support level connecting the bottoms, B and D, the Triple Bottom is not complete.

Requirement

An established uptrend is a prerequisite before identifying a Triple Top reversal.

Warnings

- The rally to the second top, Top C, is on a lighter volume compared to the volume to the previous top to the left, Top A. This may be a hint that the bulls are running out of steam.

- Tops C and E fail to exceed Top A, a sign that the bears started entering the market with short positions.

- The corrections from Top A to Bottom B and Top C to Bottom D may be on a heavier volume thus giving hints for the sellers’ inventions.

- Eventually, price breaks the support line connecting Bottoms B and D decisively on a higher volume. It is a signal that the uptrend has ended and a new trend in the opposite direction has just begun.

Price Targets

The first price target, also known as the Minimum Price Target, is measured equal to the Height (distance from Top A to the support connecting Bottoms B and D) projected from the point where the support was breached. The second price target, Price target 2, may be estimated at two times the Height where the second target, Price Target 3 is computed at three times.

Fibonacci fans usually calculate the second target, Price Target 2, at a distance equal to 261.8% of the Height of the structure. The third, Price Target 3 is estimated at 423.6% of the Height. Other variations also exist to suit the trader’s profile.

Entry

Place a Sell order below the support connecting the two bottoms, B and D.

Stop Loss

Place a protective Stop Loss on top of the pattern.

Take Profit

Close part of the position at:

- Price Target 1 - 30%

- Price Target 2 - 30%

- Price Target 3 - 40%

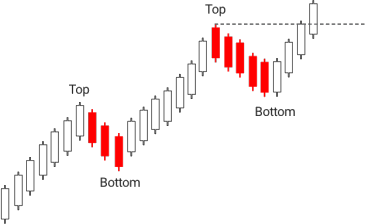

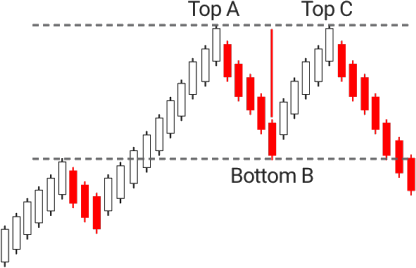

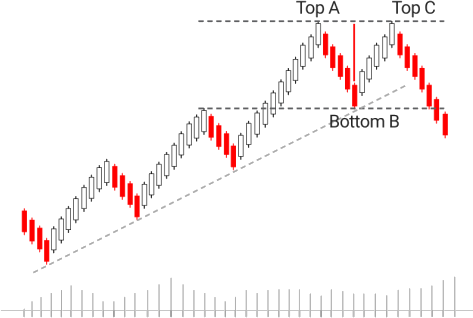

Double Top

One of the easiest to identify and more frequently occurring reversal pattern is the Double Top. It is another variation of the popular Head and Shoulders. It is a chart reversal pattern spotted at the end of the uptrend signaling the end of the prevailing trend and the very beginning of a new trend in the opposite direction, downtrend.

The Double Top formation consists of two tops at about the same price level and a bottom. The pattern is considered complete when Bottom B is breached decisively.

Requirement

A prerequisite of the Double Top reversal pattern is the existence of an established uptrend.

Warnings

Several warnings may appear alerting for the impending formation of the Double Top:

- The second top, Top C, fails to exceed the previous top signaling the weakness of the buyers to maintain the momentum to the upside.

- The rally to the second top, that is, Top C, is on a lighter volume compared to the volume to Top A. This may be a hint that the bulls are running out of steam.

- The decline from Top C usually breaks below the uptrend line.

- The decline from Top C to the support at Bottom B is accompanied by a heavier volume. This is a hint that the sellers are entering the market.

- Finally, the penetration of the support level at Bottom B on a high volume completes the pattern. It is a signal that the uptrend has ended and a new trend in the opposite direction has just begun.

Price Targets

The first price target also known as the Minimum Price Target is measured equal to the Height (distance from the Head to the Neckline) projected from the point where the Neckline was breached. The second price target, Price target 2, may be estimated at two times the Height where the second target, Price Target 3 is computed at three times.

Fibonacci fans usually calculate the second target, Price Target 2, at a distance equal to 2.618 of the Height of the structure. The third, Price Target 3 is estimated at 4.236 of the Height. Other variations also exist to suit the trader’s profile.

Entry

Place a Sell order below the support level, at Bottom B, that was violated.

Stop Loss

Place a Protective Stop Loss on top of Top A.

Take Profit

Close part of the position at:

- Price Target 1 - 30%

- Price Target 2 - 30%

- Price Target 3 - 40%

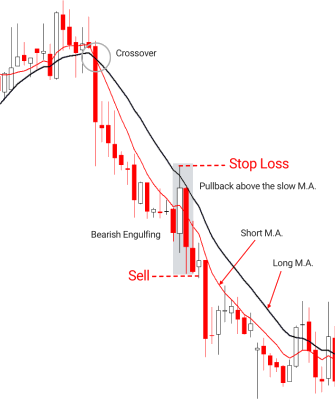

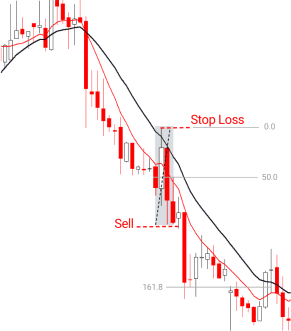

Double Crossover

A very popular strategy among traders is the combination of two moving averages, a slow and a fast or a short and long if you prefer. There are many combinations out there but in the scope of this eBook let’s take a look at the 10 and 20 periods. What is left to decide is the moving average method of calculation. It is no secret that I personally like the Linear Weighted Moving Average.

In a Double Crossover system, a sell signal is generated when the short moving average crosses below the long moving average line. In the quest to reduce false signals, this strategy suggests waiting for a pullback above the slow moving average and selling at the next Bullish Engulfing Pattern.

Remember that a Bearish Engulfing pattern is a two candlestick reversal pattern at the end of an uptrend or a rally. The first candle is a white candlestick (ideally small) in the direction of the established trend. The second is a long black candle that opens above the prior close and subsequently closes below the open of the previous white body. It signals the shift of the sentiment and the impending reversal to the downside.

Requirement

The existence of an uptrend, shown as prices hovering above both the short and the long Moving Averages.

Price Targets

The first price target (Price Target 1) is estimated at 161.8% of the Bearish Engulfing pattern. The second target (Price Target 2) is computed at 261.8% of the pattern. The final target (Price Target 3) is seen at the close above the long Moving Average. Of course, different combinations may apply to suit the trader’s profile.

Entry

- Identify a crossover between the WMA (10) and WMA (20).

- Wait for a pullback above the WMA (20), the long Moving Average.

- Spot a Bearish Engulfing pattern.

- Place a Sell order below the Bearish Engulfing pattern.

Stop Loss

Place a protective Stop Loss above the Bearish Engulfing pattern.

Take Profit

Close part of the position at:

- 261.8% - 50%

- 423.6% - 30%

- At a close below the WMA (20) – 20%

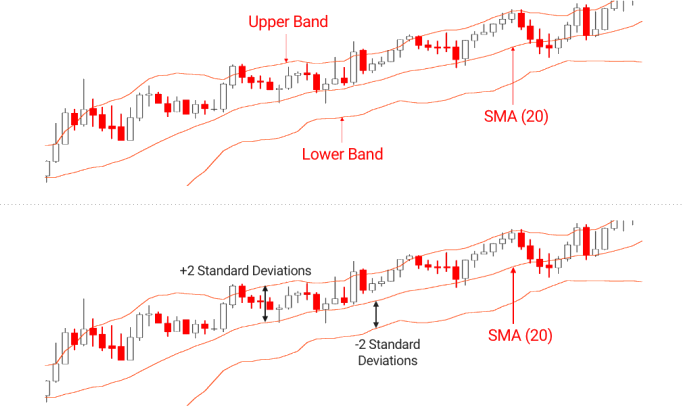

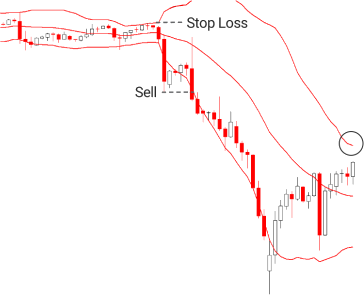

Bollinger Bands

A very popular technical tool among traders of all skill levels.

It consists of a 20-period Simple Moving Average (SMA) and two bands. The Upper band is constructed by adding two standard deviations above the SMA while the Lower band is calculated by subtracting 2 standard deviations below the SMA. Bollinger Bands:

- Measure market volatility

- Identify the trend

- Spot continuation of the prevailing trend

- Detect overextended prices

- Identify a reversal in the market

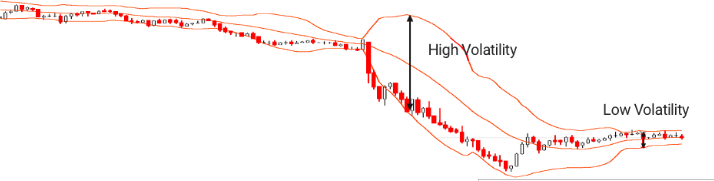

Volatility

Bollinger Bands measure market volatility. During high volatility, the bands widen whereas in low volatility the distance between the bands is narrow. Usually, periods of low volatility are followed by periods of high volatility and vice versa.

Low volatility is characterized by the narrowing of the bands, that is the Upper and Lower Bands.

The Squeeze

In periods of low volatility, the price action is confined to a narrow range called the Squeeze.

Trading the Squeeze is one of the popular methods using the Bollinger Bands as after a Squeeze an expansion of the bands is imminent. Basically, it is a range breakout strategy.

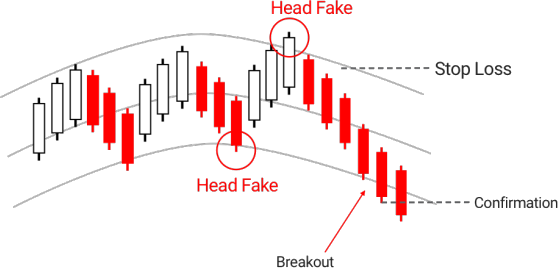

Head Fake

The Squeeze suffers from false breakouts called Head Fake. At times, a breakout may occur above the Upper Band only to find out in a while that prices fell in the opposite direction. The opposite is true as well. A breakout below the Lower Band may bounce off to the Upper Band. To minimize false breakouts, wait for a price confirmation before opening a position. A confirmation is nothing else but the next candlestick exceeding the high of the breakout candle for an upward breakout or falling below its low price in a downward breakout.

Entry

Place a Sell order below the low of the breakout candlestick.

Stop Loss

Place a Protective Stop Loss above the Upper Band.

Take Profit

Close all the positions at a close in the opposite direction above the Uper Band.

Weighted Moving Average with Bearish Engulfing filtered by Relative Strength Index

This is one of the first trading strategies that I came across when I started my trading career. It’s a straightforward strategy since it consists of a Moving Average and a Bearish Engulfing pattern. I also added filtering by a 9-period Relative Strength Index. The strategy suggests an entry to the downside once an Engulfing Bearish pattern closes below the 10-period Weighted Moving Average (WMA) and RSI (9) is in the Overbought area.

Remember that the Bearish Engulfing pattern is a two-candlestick reversal pattern at the end of an uptrend or a rally. The first candle is a white candlestick (ideally small) in the direction of the established trend. The second is a long black candle that opens above the prior close and subsequently closes below the open of the previous white body. It signals the shift of the sentiment and the impending reversal to the downside.

Requirement

The existence of an uptrend, shown as prices hovering above the Weighted Moving Average.

Price Targets

The first price target (Price Target 1) is estimated at 200% of the Bearish Engulfing pattern. The second target (Price Target 2) is computed at 300% of the pattern. The final target (Price Target 3) is seen at 400%. An immediate liquidation of the whole position is recommended at two consecutive closes above the WMA (10). Of course, different combinations may apply to suit the trader’s profile. Note that for the purpose of calculating the price targets, the High and Low price of the pattern is used.

Entry

Place a Sell order below the low of the Bearish Engulfing pattern.

Stop Loss

Place a protective Stop Loss above the high of the Bearish Engulfing pattern.

Take Profit

Close part of the position at:

- 200% - 50%

- 300% - 30%

- 400%

- Close the remaining position, if any, immediately after 2 consecutive closes below WMA (10)

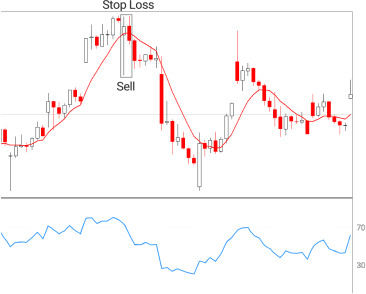

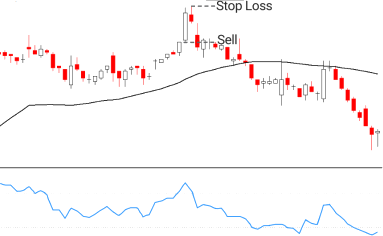

Simple Moving Average with Bearish Harami filtered by Relative Strength Index

This is another popular trading strategy that combines the Japanese Candlestick reversals, the Relative Strength Index as a filtering tool to gauge the extent of the rally while the Simple Moving Average serves as both an additional visual filtering tool and a final profit target.

This is another strategy that I experimented with, during the period when I developed a few trading robots. The parameters I selected were 50 periods for the SMA and the default, 14 periods, for RSI. The rest was straightforward. The identification of a Bearish Harami pattern above the SMA (50) triggers a warning. On a closer look, if the pattern is far above the SMA then the RSI is employed to confirm the reliability of the pattern. An overbought RSI will raise the confidence level. Consider selling when the next candle falls below the low price of the Bearish Harami pattern. Place a protective stop loss at the top of the pattern. A Take-Profit strategy is heavily dependent on the trading profile of each individual:

- Close 50% of the position when price travels 100% the length of the pattern.

- Close the remaining 50% when the price touches the SMA (50).

- Other combinations may apply.

Requirement

The existence of an uptrend is shown when prices hover above the Simple Moving Average.

Price Targets

The first price target is estimated at a distance equal to 100% of the Bearish Harami pattern. The final target is seen when the price reaches the Simple Moving Average. Of course, different combinations may apply to suit the trader’s profile. Note that for the purpose of calculating the price targets, the High and Low price of the pattern is used.

Entry

Place a Sell order below the low of the Bearish Harami pattern.

Stop Loss

Place a protective Stop Loss above the high of the Bearish Harami pattern.

Take Profit

Close part of the position at:

- 100% - 50%

- SMA (50) - Remaining 50%

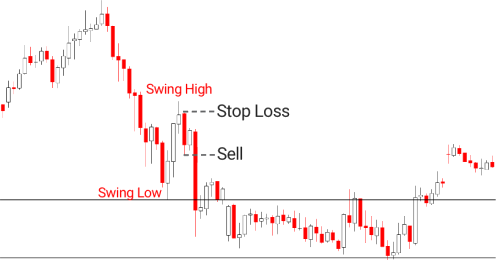

Marubozu At Resistance

Many traders, especially novices, experiment with Support and Resistance levels as an entry point. To be honest, I have never trusted support and resistance as they are associated with the range which, in my opinion, is unreliable. Nevertheless, I use the resistance during a downtrend. As you know the market does not move in a straight line. Instead, it follows a zigzag path. It dips in the direction of the downtrend and it rises in the opposite, upwards.

During the rise or correction, if you prefer, I look for a good excuse to sell near the resistance area. The advantage is twofold. The trade is in the direction of the established trend which is crucial and second, as you will find out, the risk is relatively low. The presence of a long black candle (Marubozu) or any other Japanese reversal pattern, near the resistance area will signal the strength of the sellers to push the market lower. A protective stop loss is seen at the top of the pattern. Potential profit targets are subjective. I prefer to close 50% at the bottom of the current swing low and the remaining at a distance equal to 161.8% of the swing.

Requirement

The formation of a black Marubozu near the resistance area during a correction of a downtrend.

Price Targets

The first price target, 50% of the position, is estimated at the bottom of the current swing low. The remaining is seen at a distance equal to 161.8% of the current swing.

Entry

Place a Sell order below the low of the black Marubozu.

Stop Loss

Place a protective Stop Loss above the high of the pattern.

Take Profit

Close part of the position at:

- 100% - Close 50%

- 161.8% - Close remaining 50%

Conclusion

These are some popular bearish trading strategies among many others. They combine a wide range of key technical analysis principles, concepts, and indicators. It is a good starting point for beginners and a refresher for experienced traders. Save them in your trading arsenal and practice with them until you decide which ones are for you. Devote enough time to them until you master them. The Technical Analysis will show the way. Happy trading!

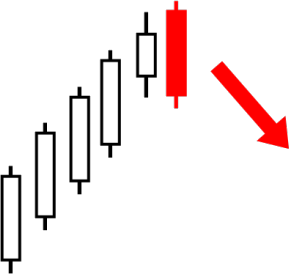

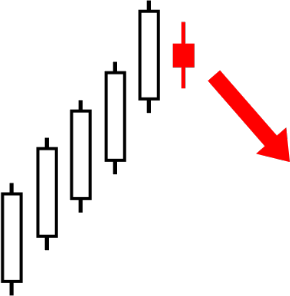

Bearish Engulfing

The Bearish Engulfing pattern appears at the top of an uptrend or rally. It consists of two candlesticks. The first is a bullish, white, smaller sized candle. The second is a long black candle signifying the strength of the sellers. The black body contains the body of the first candle.

Evening Star

The Evening Star pattern consists of three candles occurring at the top of an uptrend. The first is a long white candle followed by a small body of either color that gaps up. The small body signifies indecision which is a warning that the buyers are losing momentum. The third candle consists of a long black body that closes well into the body of the first white candlestick.

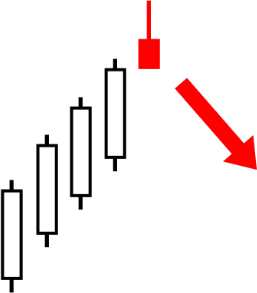

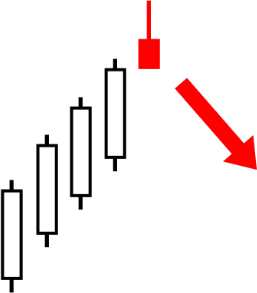

Shooting Star

The Shooting Star appears at the top of a rally indicating indecision among the traders. It consists of a small body of either color that gaps higher than the previous candle. The long upper shadow is an alert of the buyers’ failure to maintain the high prices.

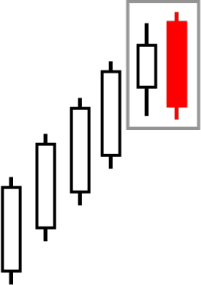

Bearish Harami

This is a two-candlestick reversal pattern formed at the top of a rally signaling an impending reversal. The first is a long white candle in the direction of the trend. The second is a small body of either color, indicating indecision, opening, and closing within the body of the previous long white body.

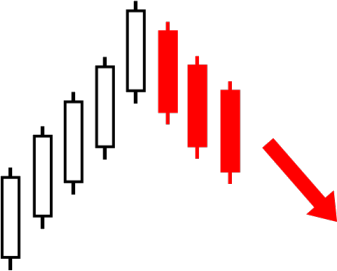

Three Black Crows

The Three Black Crows pattern is a strong signal that the sellers are in control. It consists of three long black candlesticks each opening within the body of the previous and closing lower. It appears at the top of an uptrend signaling a reversal to the downside.

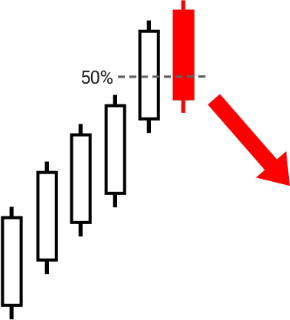

Dark Cloud Cover

The Dark Cloud Cover occurs at the top of the uptrend, signaling a reversal to the downside. It consists of two long candles of opposing color. The first is a long white candle formed in the direction of the trend. The second is a long black candle that gaps higher and eventually closes well into the previous long white body and more precisely below its 50% level.

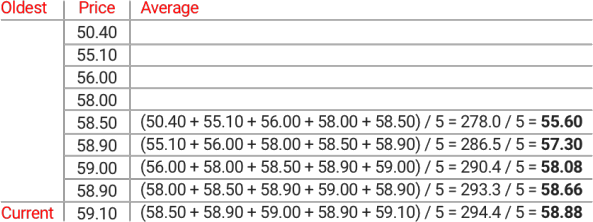

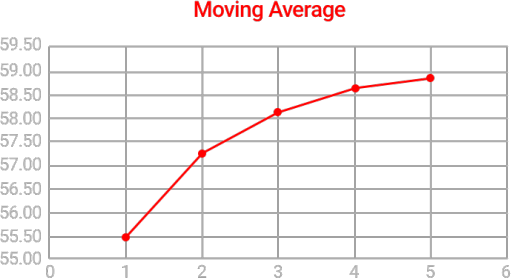

Moving Average

This is one of the most popular technical tools used in trading the financial markets. It is used to smooth out prices, remove the “noise”, identify the trend, and act as support and resistance. It is calculated as the average price of a financial instrument for a specific number of sessions (i.e. candlesticks). Simply, it is the total of a specific number of closing (this is the default) prices divided by the number of prices. For example, to calculate the 5-period Moving Average of the following prices, the top 5 prices of the table are summed and then divided by 5. Then, the oldest price is ignored, and the next 5 prices are summed and divided by 5. This process continues until the most recent price is included in the calculation.

The resulting averages are connected together with a line to form the Moving Average.

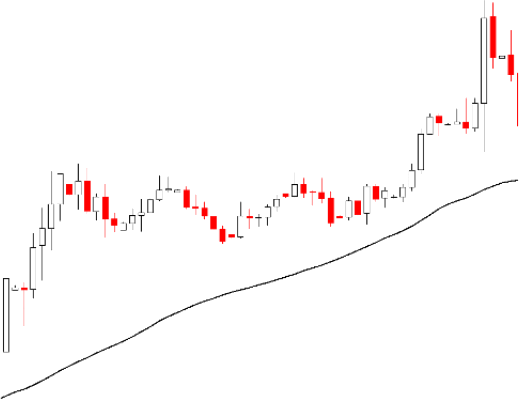

An uptrend is defined when prices are above the Moving Average. Similarly, when prices are below the Moving Average, a downtrend is in place.

Moving Averages come in different “flavors” and methods of calculation:

- Simple or Arithmetic

- Exponential

- Weighted

- Smoothed

- End Point or Least Squares

- Alan Hull

- Arnaud Legoux

- Many other

The primary difference in the above methods is the weight they assign to the most recent prices.

Buy Signal

A Buy signal is generated when prices cross above the Moving Average line.

Sell Signal

A Sell signal is generated when prices cross below the Moving Average.

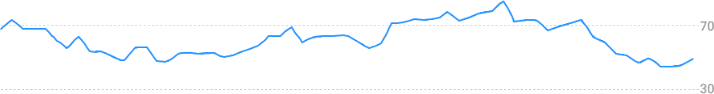

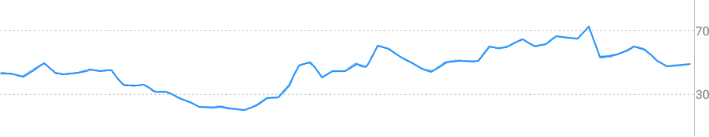

Relative Strength Index

The Relative Strength Index (RSI) is a momentum oscillator developed to smooth erratic movements caused by sharp price fluctuations and identify overextended prices both to the upside (overbought) and to the downside (oversold). The RSI bounces between 0 and 100. When the RSI crosses above 70, the market is considered overbought and traders are advised to be alert for a reversal.

On the other hand, when the RSI crosses below 30, the market is considered oversold and traders are warned to be on the lookout for a reversal in the opposite direction.

Buy/Sell Signals

Both overbought and oversold extremes are best used as filtering tools rather than generating buy/sell signals. A reversal pattern may be considered to be more reliable when the RSI is in the extreme overbought/ oversold areas.